Computes the mean, standard deviation, skewness, kurtosis, Value-at-Risk (VaR) and Conditional Value-at-Risk CVaR) under flexible probabilities.

Usage

empirical_stats(x, p, level = 0.01)

# S3 method for default

empirical_stats(x, p, level = 0.01)

# S3 method for numeric

empirical_stats(x, p, level = 0.01)

# S3 method for matrix

empirical_stats(x, p, level = 0.01)

# S3 method for xts

empirical_stats(x, p, level = 0.01)

# S3 method for ts

empirical_stats(x, p, level = 0.01)

# S3 method for data.frame

empirical_stats(x, p, level = 0.01)

# S3 method for tbl_df

empirical_stats(x, p, level = 0.01)Arguments

- x

A time series defining the scenario-probability distribution.

- p

An object of the

ffpclass.- level

A number with the desired probability level. The default is

level = 0.01.

Value

A tidy tibble with 3 columns:

stat: a column with

Mu,Std,Skew,Kurt,VaRandCVaR.name: the asset names.

value: the computed value for each statistic.

Examples

library(dplyr, warn.conflicts = FALSE)

library(ggplot2)

ret <- diff(log(EuStockMarkets))

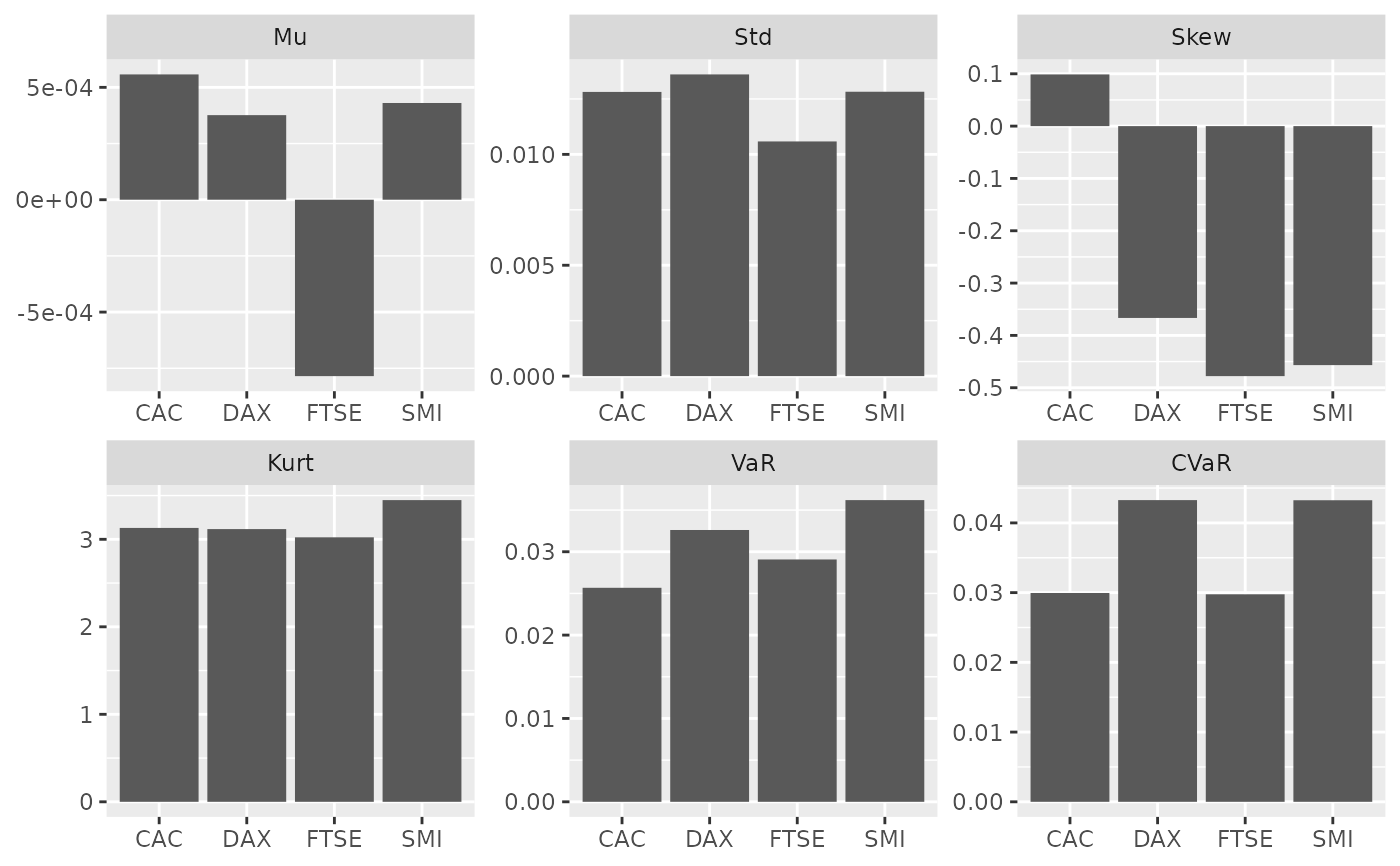

# with equal weights (standard scenario)

ew <- rep(1 / nrow(ret), nrow(ret))

empirical_stats(x = ret, p = as_ffp(ew)) %>%

ggplot(aes(x = name, y = value)) +

geom_col() +

facet_wrap(~stat, scales = "free") +

labs(x = NULL, y = NULL)

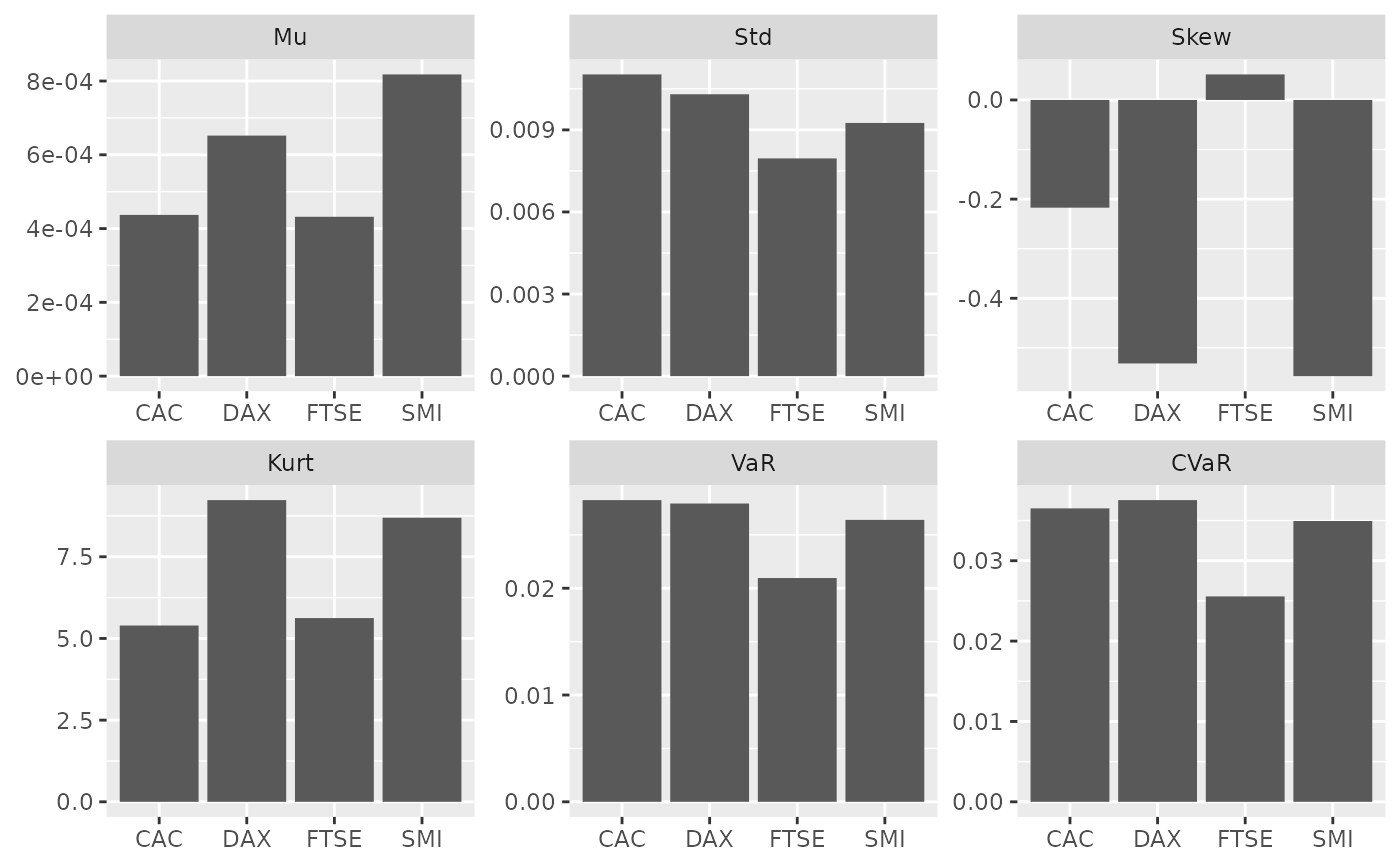

# with ffp

exp_smooth <- exp_decay(ret, 0.015)

empirical_stats(ret, exp_smooth) %>%

ggplot(aes(x = name, y = value)) +

geom_col() +

facet_wrap(~stat, scales = "free") +

labs(x = NULL, y = NULL)

# with ffp

exp_smooth <- exp_decay(ret, 0.015)

empirical_stats(ret, exp_smooth) %>%

ggplot(aes(x = name, y = value)) +

geom_col() +

facet_wrap(~stat, scales = "free") +

labs(x = NULL, y = NULL)